5 Methods of Hospital Reimbursement (Clone)

For healthcare financial staff, some cycles are so common they are taken for granted – day and night, seasonal changes, month-end close, year-end reporting. On one hand there is the age-old adage, ‘the only constant in life is change’ and on the other hand ‘the more things change, the more they stay the same’. When providers approach the task of monitoring payer reimbursement, the doctrine of cycles certainly apply.

To ensure an efficient workflow, healthcare providers should have a contract management system as the framework for managing the four components of the governance / communication processes.

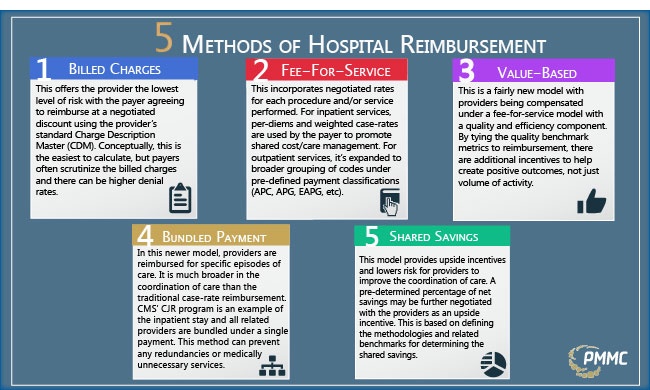

- Discount from Billed Charges: This offers the provider the lowest level of risk with the payer agreeing to reimburse at a negotiated discount using the provider’s standard Charge Description Master (CDM) which serves to track activity/usage and billing. Conceptually, this is the easiest to calculate, but payers often scrutinize the billed charges and there can be higher denial rates which can lead to additional audit/recovery work.

- Fee-for-Service: This model incorporates specific negotiated rates for each procedure and/or service performed, but overtime, additional cost-controls / care-management components have been included. For inpatient services, per-diems and defined or relative weight case-rates are used by the payer to promote shared cost/care management. Providers often negotiate stop-loss provisions, carve-outs for high-cost items as a means of balancing out the risk. For outpatient services, fee-for-service started with simple rate schedules for individual procedures but this has been expanded to broader grouping of codes under pre-defined ambulatory payment classifications (APC, APG, EAPG, etc.). Additional levels of cost/care controls are often incorporated in the negotiation process including lesser-of the charge or reimbursement, observation or minimum stay criteria, multiple-procedure discounting, and modifier & bundling logic, but there are often few controls on the number of procedures and/or preventative care strategies.

- Value-based Reimbursement: This is a fairly new model with providers being compensated under a fee-for-service model with a quality and efficiency component. By tying the quality benchmark metrics to reimbursement, there are additional incentives to help create positive outcomes, not just the volume of activity.

- Bundled Payment: In this newer model, healthcare providers are reimbursed for specific episodes of care. It is much broader in the coordination of care than the traditional case-rate reimbursement. CMS’ Comprehensive Joint Replacement (CJR) program is an example where the inpatient stay and all related providers are bundled under a single payment. This method encourages greater coordination of care and can prevent redundant or medically unnecessary services.

- Shared Savings: This model provides upside incentives and lowers risk for providers to improve the coordination of care and outcomes within an identified patient population. A pre-determined percentage of net savings may be further negotiated with the providers as an upside incentive. This approach is based on defining the methodologies and related benchmarks for determining the shared savings.

The ebb and flow of contract management follows a rhythm. The components of monitoring payer reimbursement should incorporate these metrics along the way. As a continuous cyclical process, these items will help ensure your contract governance system is always moving a step up and forward.

To learn more about the metrics that you should be tracking in your contract management system, download the whitepaper Revenue Integrity: Key Metrics for Hospital Contract Management.

About Greg Kay

Greg has managed and consulted in healthcare for 28 years. He has been with PMMC for the past 20 years and prior to that was the VP of Sales for PCA (Beverly Enterprises’ pharmacy division). Greg has experience in multisite operations management, managed care negotiation from a healthcare provider’s vantage point, and product development/implementation. Greg is a University of South Carolina finance and marketing graduate. Greg was recognized in 2012 as a Business Leader Top 50 Entrepreneur.