A New Era for Hospital Finance: Being Accountable for Things Beyond Your Control

Significant Changes Coming - Get Ready Now

On November 16, 2015, The Department of Health and Human Services (HHS) announced that CMS has approval for the final rule for the Comprehensive Care for Joint Replacement (CJR) Payment Model for Acute Care Hospitals Furnishing Lower Extremity Joint Replacement Services . It will be applicable in April 2016.

CJR is the first mandatory bundle model, and it represents the prototype for massive change in healthcare finance that will take place in the next two years.

Background and Summary

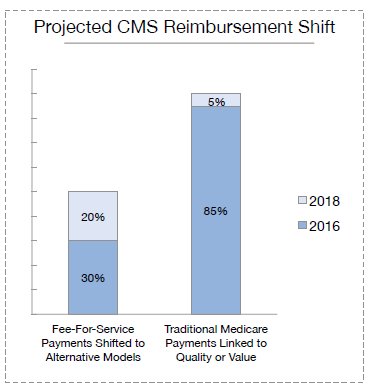

In July 2015, HHS announced its intention to begin shifting a significant portion of Medicare reimbursement to alternative payment models based on quality and value as opposed to quantity of service. Medicare had previous voluntary value-based bundling initiatives, but in July it announced a mandatory project for lower joint replacement. This project is to be launched in 67 markets in April 2016. It is the tip of the sword of a larger plan to convert 50% of Medicare’s current fee-for-service payments to alternative forms of payment by 2018. Very soon, hospital CFOs will remember our current fee-for-service payments as “the good old days” when success correlated with simply controlling cost and managing revenue.

The essence of the CJR bundle model is that it does not involve either bundling of bills or bundling of payments, but instead it will hold hospitals accountable for managing Medicare’s cost for a 90 day episode of care. All post-acute care claims for 90 days subsequent from the inpatient discharge will be billed and paid by fee schedule as usual, but Medicare will have a target amount for the total payments. The target amount will be a discount from historical episodic costs.

The target prices for an episode of care for the five year program are to be calculated to produce a 2% savings for Medicare. The initial targets will be weighted toward specific hospital experience but will migrate by Year Four to have the same target rate for all hospitals in a Census Division. The country is divided into nine Census Divisions.

*image provided by Healthcare Business Insights (HBI)

CMS will have a yearly audit with the impacted hospitals to reconcile whether CMS paid more or less than the established target amounts for all 90 day episodes of care for CJR. If CMS paid less than the target rate in aggregate, then the hospital will participate in shared savings and receive a bonus payment. If CMS paid out more than the target rate for all the episodes of care, then the hospital will pay money back to CMS, up to a limit. In the first year of the program hospitals are not subject to paying money back, but they can participate in shared savings. Hospitals in the 67 markets that are participating in other CMS value-based purchasing initiatives are exempt from the CJR project as long as they remain participants in the other programs.

Based on the announced intent, this is the just the beginning of future CMS Episode of Care models. Also, history has shown that commercial payers will likely follow the path that CMS lays for healthcare purchasing.

Potential Financial Impact of CJR

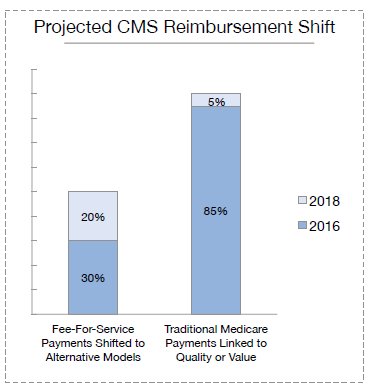

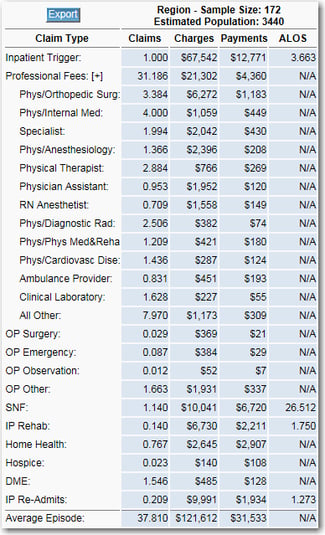

CMS has published projected savings. CMS will get its savings, either through providers lowering post-acute care claims, or by hospitals paying back the penalties for costly episodes. The challenge for hospitals is that the only money they are due to be paid is the MS-DRG rate they get for the inpatient trigger event that starts the episode. The total cost of the episode can be twice the inpatient hospital payment, so they could have to give back a hefty percentage of the inpatient payments to reconcile the episodes. Here is a sample projection for one hospital in one of the impacted markets.

Medicare CJR Bundling - Estimating What's at Risk

*image provided by Healthcare Business Insights (HBI)

In this projection, the hospital’s rate of payment is $12,771 for MS-DRG 470. The Medicare target for the episode of care starts at $28,695 in Year One and decreases to $24,633 by Year Four of the program. This decrease is due to the hospital’s episode cost being higher than the Census Division. As the target moves to the standardized Census Division rate, it is decreasing for this hospital. One would need to back out a percentage of volume if there are Medicare Advantage plans in the market. Measured at the individual level, by Year 5 a hospital could have to pay back $4,926 ($24,633 * .2) to CMS. This represents 38.5% of the inpatient payment. That is the worst case scenario, but it illustrates the magnitude of revenue at risk for a service that is frequently high volume.

What should finance do first?

Contact CMS!

CMS has announced that it will be sharing data with hospitals, and CMS requested on November 19, 2015 that hospitals in the 67 MSAs contact CMS directly to establish two (2) points of contact at each hospital. These points of contact must be hospital employees and cannot be consultants or sub-contractors. The data sharing will not begin until after January 2016, but CMS is asking for help in establishing the communication channel. CMS requests that the hospital include the facility’s CMS Certification Number (CCN) or Medicare Provider number. Contact CMS at: CJR@CMS.HHS.Gov

What is the role of finance for CJR?

Finance needs to lead the data analysis to understand the financial implications for the organization and to support care coordination.

- Finance should get external Episodic benchmark data and share it with internal stakeholders as well as collaborators and potential collaborators (post-acute care providers and others).

- Finance should get internal Episodic data and share it with care coordination staff and relevant stakeholders and collaborators.

- Finance should put into place plans to analyze CJR-specific data that CMS will begin to provide in 2016.

Most health systems already have care coordination teams and experience with integrated healthcare delivery of some type. Population Health professionals deal with quality metrics and outcomes, but they don’t all understand the mechanics of billing and payment. Few hospitals have ever been responsible for all post-acute care in a manner like the new CJR model mandates, and it is rare to find an individual who understands the financial nuances of reimbursement and the Revenue Cycle who is also clinically trained.

Hospitals will now be held financially responsible for the rate of consumption of healthcare services during the inpatient stay after patients are discharged. Providers cannot influence the fee schedule rates, but they are expected to influence utilization. The only way for a hospital to avoid penalties, or better, to participate in gain sharing, is to watch, influence, and manage inpatient and post-discharge utilization.

For many in hospital revenue cycle and finance, the current fee-for-service model and mindset will be challenged. It is no longer good enough to figure out how to manage costs while getting paid by Medicare’s already low fee schedules. It is necessary now to figure out how to lower claims volume during the inpatient stay and post discharge. For all of the post-acute care providers / potential “collaborators” however, lowering fee-for-service claims volume means lowering income and potentially altering the cost structure(s). In the CJR model, the post-acute care providers do not have much, if any, incentive to change their behavior. CMS is encouraging hospitals to implement incentives and to share risks and rewards.

If the rules of the game are changing, it is fair to ask…and answer, "What should Finance do?"

Should Finance take the lead in managing the post-acute care journey for each patient?

No. Leading institutions have qualified clinical teams and resources. Finance does, however, manage billing and payment for the hospital. It also provides Decision Support. If care coordination staff do not have a way to see all post-acute care claims to monitor utilization on active episodes, this is an opportunity for Finance to initiate the project to begin to receive post-acute care billing data. Finance will be very involved in collaborator identification and structuring any risk sharing.

Will Finance be held accountable if resource consumption patterns do not improve?

Yes. It will come from the bottom line, and it will quickly become a Finance problem.

So, what is the role of Finance?

What is Finance good at doing? Measuring, monitoring, negotiating, and making informed decisions to protect the institution’s operations and bottom line.

Where will these skills be useful for CJR?

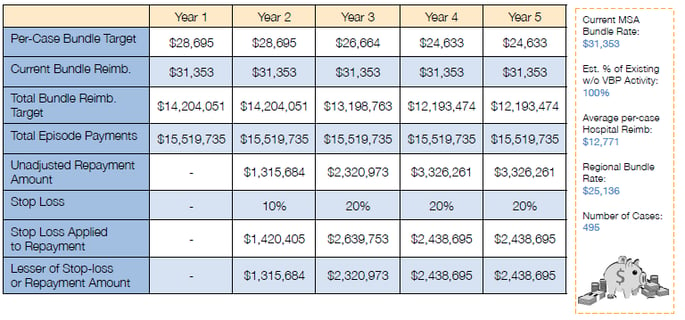

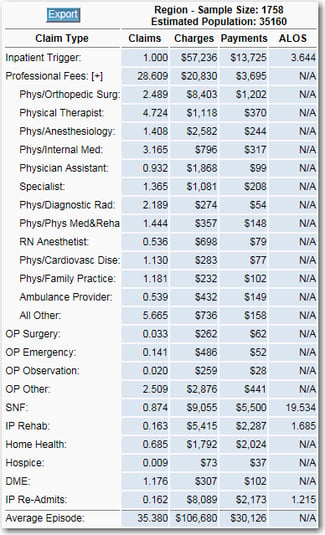

First, Finance can help the clinicians see the bigger picture that CMS saw when it chose MS-DRGs 469 and 470 to target for this program. Finance can provide executive level perspective to show all stake-holders what is in the typical bundle. There can be 25 to 35 claims per episode. These claims involve many professional fees from Orthopedics, Pain Management, and Primary Care as well as SNF, Home Health, and others. Re-admissions occur as well. All of these can be used for benchmarking what Medicare sees.

This is the perspective that CMS uses when it develops its Census Division Target Prices. Yes, the Target Price starts as a blend of local hospital and larger area, but it is migrating toward the larger Census Division. Allowing all stakeholders to see Census Division level benchmarks will get everyone oriented on the big picture. Below is an example of a Census Division profile for CJR.

Sample Census Region Episode Profile Sample MSA Episode Profile

Second, Finance can help the clinicians see what their hospital looks like for a full episode of care. This data is available and it is probably already in every hospital impacted by CJR. How can Finance get it? Go find the Quality people. They will have it. It is called the Medicare Spending Per Beneficiary (MSPB) file and every hospital that participates in Medicare’s quality measurement will have this data. Using this data, one can create a profile of the unique hospital’s episodes of care for MS-DRG 469 and 470. This will show the total number of post-acute care claims and the type of providers. Additionally, this will show the identities of the various providers.

This is also the solution for the “Leakage Problem” that concerns most hospitals trying to prepare for CJR. Using the MSPB file(s), which have been used for quality metrics, finance staff are now able to identify by name(s) and location(s) the array of providers that discharged patients are seeing. There are three files that comprise MSPB, and it will take skills in developing a relational database as well as knowledge of bundling logic. These files, however, hold the key data for developing a strategy and educating providers for what changes will need to occur.

Third, share items one (big picture Census Division Episode of Care benchmarks) and two (local hospital) with everyone. Allowing the post-acute care clinical staff to evaluate and use this data will give them the content from which they can map out a course.

Fourth, Finance should be the conduit for sharing with clinical leaders, care coordination, and collaborators the analysis of data as CMS releases it. While there are no specifics for the content and the frequency yet, CMS announced on November 19, 2015 the following data release goal:

”Data is available for the hospital’s baseline period and no less often than on a quarterly basis with the goal of as often as on a monthly basis if practicable during a hospital’s performance period.”

This is Finance’s domain and Finance should take the lead in data capture, analysis, and dissemination.

Is that all for finance?

No. The hospital is counting on Finance to know and communicate the size of this proposed change. Finance is good at measuring, decision making, and planning. The organization needs to have an understanding of the magnitude of the CJR opportunity. Does this bundle initiative present a risk to millions of dollars or does it present a risk to a couple of hundred thousand dollars? What is the realistic gain-share opportunity? The magnitude of these things should be known while allocating resources to this experiment.

It will be Finance that initiates the analysis of leakage and will likely initiate the strategic analysis of aligning and/or not aligning with various post-acute care providers currently providing services in the market.

In some ways CMS has given Finance a gift. There are no penalties in Year One, and there is a chance for gain sharing. Finance teams that recognize the CJR project as the launch point for Medicare’s “alternative payments” will be better positioned and experienced for the next bundle initiative when it comes.

If Finance Does These Things, What Will Happen?

A better question may be, “what will happen if Finance does not do these things?” The answer to that will be significant financial loss that will cause the institution to be weakened. It could become vulnerable to lowered finance and quality ratings as well as vulnerable to losing control of its destiny as a community asset. Leadership will make adjustments, and there will be consequences.

So, if Finance does these things it will assert its role of helping the care givers understand what is at stake. Certainly, the care givers understand the concept of risk and the burden that is being placed on the hospitals. What the care givers cannot be expected to know, however, is the array of claims in an episode or their value. The ability to use CJR as a vehicle for collaboration between Finance and care givers is actually a great opportunity. This is just the beginning.

Summary

The CJR Model is a potential prototype for changing healthcare finance. Medicare has devised a forceful means to get hospitals more involved in managing full episodes of care. For most, the stick is much bigger than the carrot, and hospital finance will be tested. Fortunately, there are benchmarking resources available that the finance team can use to inform stakeholders and equip care management for managing the impending change as well as monitoring tools to ensure success.

To learn more about the CJR model and its potential financial impact, watch the webinar below.

About Palmer Hamilton

Palmer Hamilton has over 25 years of healthcare experience with hospitals and insurers. He has a BA in English from VMI as well as an MBA from Wake Forest University, and he served as a Captain in the US Army. He has spoken at several HFMA events and has been published as well. His experience includes most aspects of the Revenue Cycle, and he is currently product manager for Online Analytics, a web-based solution for healthcare finance benchmarking.