Can You Lower Hospital Chargemaster Prices Without Sacrificing Net Revenue? You Might Be Surprised

Executives in the healthcare industry are constantly looking for more accurate ways to manage and balance their pricing strategies.

They feel pressure from the community, the Hospital Board, and state legislatures to be transparent about prices while trying to stay viable and meet net revenue goals.

The purpose of the Chargemaster is to provide a comprehensive list detailing the official rate charged by a hospital for individual procedures, services, and goods.So how do you respond when the Hospital Board asks, “Why can’t you just lower your charges?”

We know that in healthcare, it’s more complicated than that. An average hospital will have 11,000 Chargemaster lines, 50-70 different departments, 20-30 payer contracts and thousands of patient visits per week.

Some hospitals’ pricing strategy is to just implement a standard “across-the-board” price increase every year – where each charge is increased by the same percentage rate. It sounds clean and simple, but that honestly doesn’t cut it anymore.

Think of a chargemaster pricing review like tax season. It’s something everybody has to complete every year – and many people look for advantages to reduce their tax bill and improve their financial position.

Remember earlier in our lives when all we had to fill out was the 1040EZ? In comparison, those were the days of the simple across-the-board increases. As our lives became more complicated and we add investment income and layers of deductions– our taxes become more complicated. The same goes for the Chargemaster.

Over the years, providers added new services and related charge items as well as expanded payer contractual arrangements to different reimbursement arrangements. It becomes more and more challenging to stay with the simple approach. At some point, you need to incorporate strategic pricing software tools along with the right expertise in this unique area of the revenue cycle.

So what can Chargemaster adjustment software do for us? For one, it allows us to make strategic adjustments to the CDM. At a high level, this is done by analyzing the current rates, contracts, and prices relative to the market.

Adjusting charges is often a balancing act

Ask yourself the question “Which areas are priced too high relative to the market and is there a way to lower those charges without hurting your bottom line?”

By asking this question, hospital executives can determine if the high charges are justified or if their charges are just inflated relative to the actual reimbursement for services relative to the market. High charges often fuel a "high-cost" misperception when charges are not really as relevant to net revenue as the public might assume. This misperception in turn drives the need for greater pricing transparency.

One strategy that hospitals are embracing is to target items that have fixed-fee contractual reimbursement, as the charge with these items can be decreased to the fixed reimbursement rate with little impact on net revenue. However, there are a few factors at play we need to consider.

Let’s use MS-DRG 795 (normal newborn) as an example. In this scenario, a hospital is paid the lesser-of-charges or the contractual rate which could be a defined case-rate or per-diem that covers a defined group of procedures and services.

At a high level, if this procedure averages $2,300 in charges and the contractual case-rate is $1,600, a hospital could lower their charges to $1,600 and be just above the negotiated allowed amount of $1,600.

Charges are at the charge code level, so keep in mind we also need to determine the charge codes and volumes associated with MS-DRG 795 to hit the hospital’s net revenue goal. Furthermore, the charge codes used in a delivery are also used in other procedures and conflicting goals associated with rate modeling at the detail line level almost always arise.

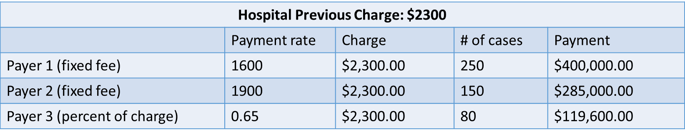

Another important point to note is that contracts reimburse differently, so adjusting charges is a balancing act on many levels. Let’s use the normal newborn example again with three different payers:

- Payer 1 pays a $1,600 per case-rate and has 250 cases annually (fixed rate)

- Payer 2 pays a $1,900 per case-rate and has 150 cases annually (fixed rate)

- Payer 3 pays 65% of charges and has 80 cases annually (percentage of charge)

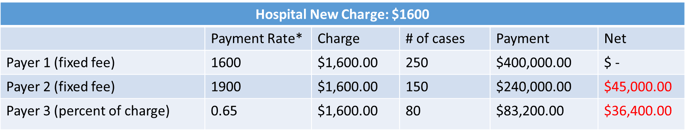

From the tables above, let’s examine the impact on net revenue if the hospital reduces its charges from $2,300 to $1,600 for this specific DRG:

- Payer 1: There is no impact on net revenue from Payer 1, since the payment to the hospital is already $1,600.

- Payer 2: This is where the lesser-of-charge kicks in. Due to the lesser-of-charge contract, the hospital will only be paid $1,600 (the new charge) and will result in a net loss of $45,000.

- Payer 3: Because the payment is only a percent of charge (65%), this results in a net loss to the hospital of $36,400.

(And this is only for one DRG code!!)

These different reimbursement methods, combined with the fact that the charge codes used with a normal newborn are also used in other procedures, highlights the need for Chargemaster (CDM) rate adjustment software that integrates with contract management calculations. This type of software can identify the ideal price point where you can lower charges at the charge code level without sacrificing net revenue and test lesser of charges hits at the case level for various pricing scenarios.

So, can a hospital actually lower charges without sacrificing net revenue?

Absolutely yes.

But results depend on your payer contracts and the ability to model on multiple levels simultaneously. It’s important to answer to the outside community and market, but it requires in-depth modeling to uncover where the hospital can make those strategic adjustments and how aggressive the decreases can be. That's the only way hospitals can meet the conflicting demands of price transparency and net revenue goals.