The Ultimate Guide to Your Next Chargemaster Review

The Chargemaster (CDM) review is one of the most important initiatives for a hospital prior to the new fiscal year and requires a balancing act between price transparency demands and net revenue impact.

It's a huge undertaking and if you manage the Chargemaster at your hospital, your team is likely small with limited resources.

This action plan is designed to help guide the way and ensure your next Chargemaster review is successful!

1. Understand Your Hospital's Market Position

Historically, hospitals would raise prices to maximize reimbursement within their contract limits and services with percent of charge reimbursement were targeted to optimize revenue.

Admittedly, strategic pricing is the cause for many hospitals having some services overpriced and others under-priced.

As part of the strategic pricing process which maximized reimbursement, hospitals brought in market data to use as guardrails to prevent standing out. This process doesn’t leave hospitals with pricing that is rational to the customer or pricing that is competitive with surgery centers, imaging centers, retail clinics, or similar non-hospital alternatives.

Today, for many organizations, there are only a small number of payer contracts that have a percent of charge component.

The incentive to raise prices in these areas isn’t as substantial as it once was, so we need to change the way we approach pricing.

Hospitals need to re-balance pricing with the underlying value and begin to move commercial payment terms in that direction without losing margin in the process.

Until the payers are willing to help hospitals realign pricing, hospitals will still need to pay attention to market data, charge sensitivity of items and lesser of terms, with a strategy to move toward rational pricing.

This brings us to the first step in a Chargemaster review, which is understanding your hospital's market position today.

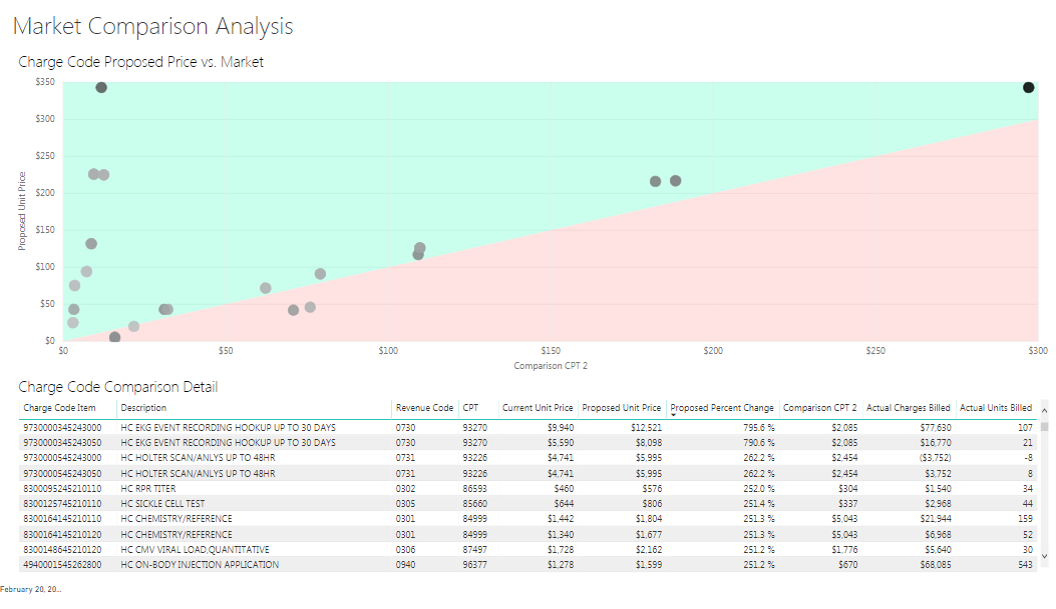

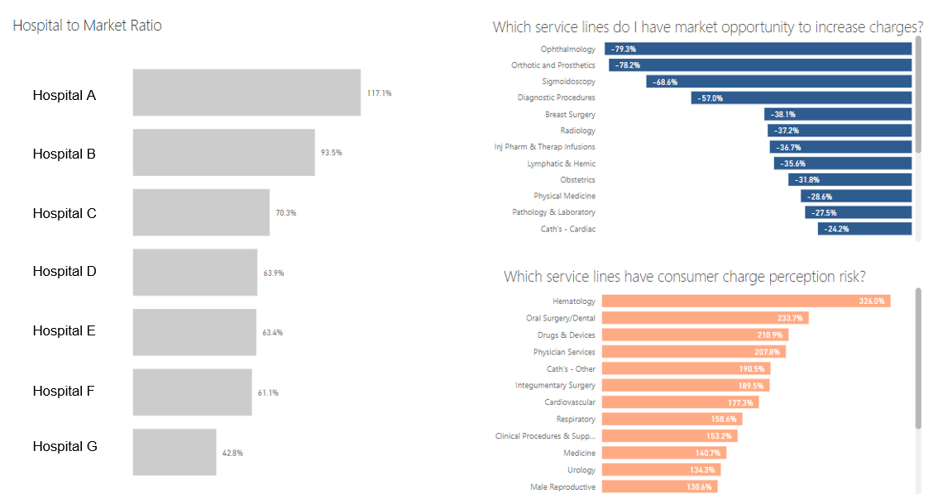

Analytics, like in the dashboard below, can help you easily see your position:

Historically, it didn’t pay for you to be below the market charge. Low prices often equated to missed revenue opportunities. Today, this is changing. With more price shopping and less charge sensitivity in contracts, lower prices can be an advantage.

However, every hospital is different. Your ideal price position will depend on the level of competition in your area and the terms of your commercial contracts.

Let's walk through a couple of real examples:

"We're 20% Above Market"A few years ago, I was asked to perform a pricing project for a hospital that was 20% above all local and regional competition.

I don’t mean for just a few services -- they were consistently very high.

They knew it was from years of 10% price increases to boost the bottom line. The organization was financially very healthy but leadership said it was time to "stop riding the gravy train."

The organization was still holding on to a few large charge sensitive contracts so they knew they would face a revenue challenge when they decreased prices, but wanted to get in front of the problem before they started losing market share.

We modeled a lot of scenarios and worked to try and minimize the net revenue impact of the gross revenue decrease, but as you would expect with a 20% price decrease, the hospital still took a hit.

"We Have Mostly Prospective Payment Commercial Contracts"Another example is a hospital that had mostly prospective payment commercial contracts. They were priced high in the market and the board tasked the organization to lower charges because they felt they could achieve a better market position without giving up net revenue due to the prospective contract terms.

We modeled scenarios and provided analytics to show how net revenue trended alongside gross revenue decreases.

We were also able to provide drill down analytics to provide insight as to why a hospital with flat rates on all of their large contracts couldn’t successfully bring charges own without taking a hit. In this case, it was a Blue Cross Traditional plan that was percentage of charges. It was lower volume, but proved significant enough to impact the financials.

2. Embrace 'Rational' Pricing, Not Strategic Pricing

The two examples above were challenging because both organizations were seeking significant price decreases.

For most health systems or hospitals we work with, we’ve been able to perform small annual decreases without impacting net revenue, or they’ve agreed to a multi-year approach that allowed them to spread the net revenue hit across a few years.

As healthcare shifts to more consumerism, we need to begin changing our mindset away from Strategic Pricing projects and more towards Rational Pricing methodologies that takes the patient into consideration.

You may still have a few smaller percent of charge commercial contracts or certain areas in your larger contracts that reimburse based on your gross charges. Our mindset for so long was ‘my contract allows me to increase charges and so I still need to increase the charge sensitive areas’ but we have to start thinking about things differently.

We might be incentivized by contracts to make price adjustments, but does this rationally make sense?

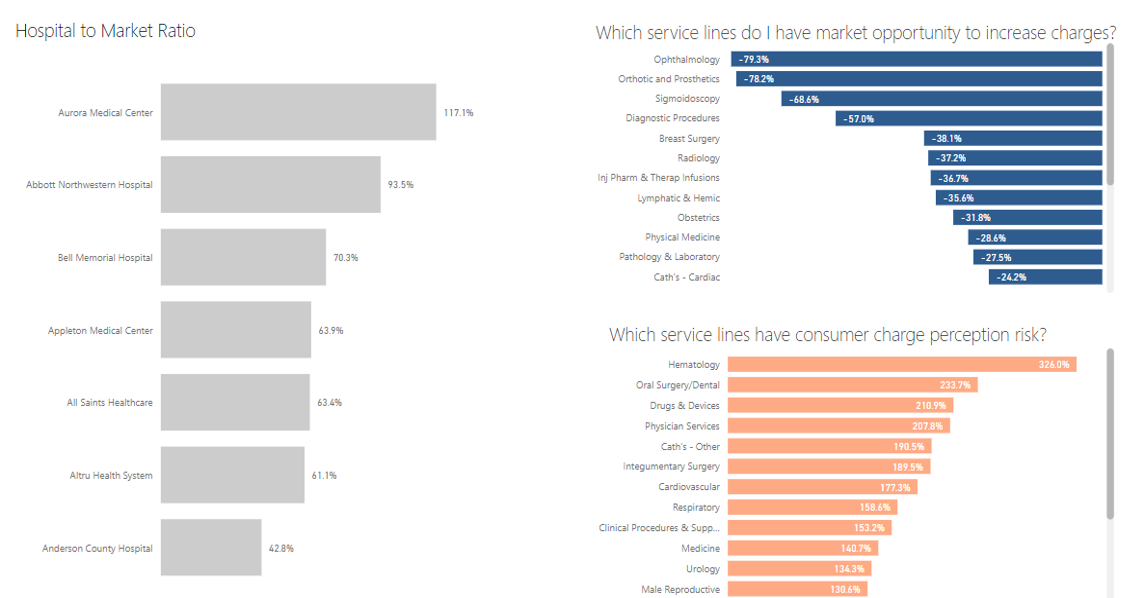

Let's start looking at service lines for not only opportunities to increase charges, but also those that have consumer perception risk, as seen here:

3. Model Scenarios to Understand the Net Revenue Impact

Now let’s talk about a more difficult task. Making the move to rational pricing requires a hospital or health system to find the balance on competitive pricing and the bottom line. As you adjust prices, it’s important to be able to easily monitor and evaluate the net revenue impact. It’s also very helpful to show these numbers to administration or the board to help them weigh in on goals related to price transparency and consumerism. These goals can compromise revenue, and scenario modeling will show that and help them decide where to draw the line for the organization.

In this scenario below, the difference in Draft 3A and Draft 3B is isolated to a few MRI codes that are being balanced with increases to surgery and room and board. Being able to see the difference in the net impact helps this hospital decide just how far they can lower these codes without turning their financials upside down.

4. Integrate New Price Transparency Mandates

Price transparency mandates are prodding us to move from traditional price shifting and optimizing tactics through various strategic pricing moves to a more rational pricing methodology.

Going forward you need to begin thinking about how you are going to use comparative charge and reimbursement data to your advantage.

You need to begin thinking about not just how you are going to post these files, but how you are going to leverage new data and insight for more rational pricing and a stronger bottom line through improved negotiations with your payers.

For now, let's review the CMS requirements for January 1, 2021.

The first requirement, the Standard Charge File, must include five components:

-

The Gross Charges for items and services reflected on the hospital’s CDM

-

The Discount Cash Price: this is the cash price for patients that pay at time of service. This requirement was added based on the hospital’s industry comments

-

The Payer-specific Negotiated Charge: this is one of the more controversial items

-

The de-identified min and max charge that list the lowest and the highest negotiated rate for each line item and service.

For January 1, 2021, your posted List of Standard Charges must follow the new Price Transparency final rules. This means your current file with only the charge code description and the charge amount must include additional data elements.

It is important to note, CMS specifically called out the fact that with the machine readable file it has to be available without restriction. It should be a single file with all the required List of Standard Charges – Gross Charge, Cash Price, De-Identified Min & Max and Negotiated Charge for all Payers/Plans. As a single file, CMS outlined in their Learning Network event, that the data can be presented in multiple tabs.

The second requirement, the list of Shoppable Services has two options:

-

A comprehensive machine-readable file

-

A consumer-friendly patient estimation tool

For the shoppable services, CMS indicated hospitals have a choice of posting a list of 300 shoppable items as a file with the noted allowable for all payers or deploying a patient estimation tool that provides the consumer with an estimate of their cost. If you elect to post a shoppable file, CMS provided an example in the final rule with the file layout.

CMS noted they are providing a lot of flexibility with how the estimated patient cost is presented to the consumer if you go that route. There are guidelines and minimum requirements such as 300 shoppable items must be included with a minimum of the 70 CMS provided items, and the estimate must be available in real-time.

For the consumer-friendly patient estimation tool, CMS recognized the need to capture certain patient demographic data such as name, insurance group number, date of birth, etc to confirm insurance eligibility and incorporate real-time patient benefit data (current deductible, co-insurance, co-pay and remaining out of pocket).

CMS acknowledged many hospitals have self-service estimation tools that allow patients to create an estimate of their cost prior to a service and those tools will meet the mandate requirement. Consumers want to understand their cost and these tools provide that ability in a more efficient way.

For more information on meeting the price transparency mandate, click here.

5. Analyze Lesser of Charges

Now let's get into some detail around lesser of charges to understand how this is going to affect net revenue.

Lesser of charges language appears in many prospective contracts. It’s a clause that states payers will pay the lesser of the contracted reimbursement rate or the hospital’s gross charges.

Lesser of charges is really straightforward for many of your shoppable services. For example, you have a CPT code for a lab panel and you want to reduce the price. You can compile your fee schedules, take the max of them and reduce your price but make sure you stay at or above that threshold. Easy, right?

But shoppables aren’t just lab and radiology these days.

In the upcoming mandate, on CMS’s list of 70 shoppable services, there are 5 MS-DRGs and 30 codes total that are considered Medicine or Surgery and I think we’ll see more like these in the future. Charges for surgery are typically variable and make lesser of charges more of a challenge.

For those of you who want to decrease a few charges to areas such as surgery that don’t have a fixed price, you need to monitor the net revenue impact to these areas.

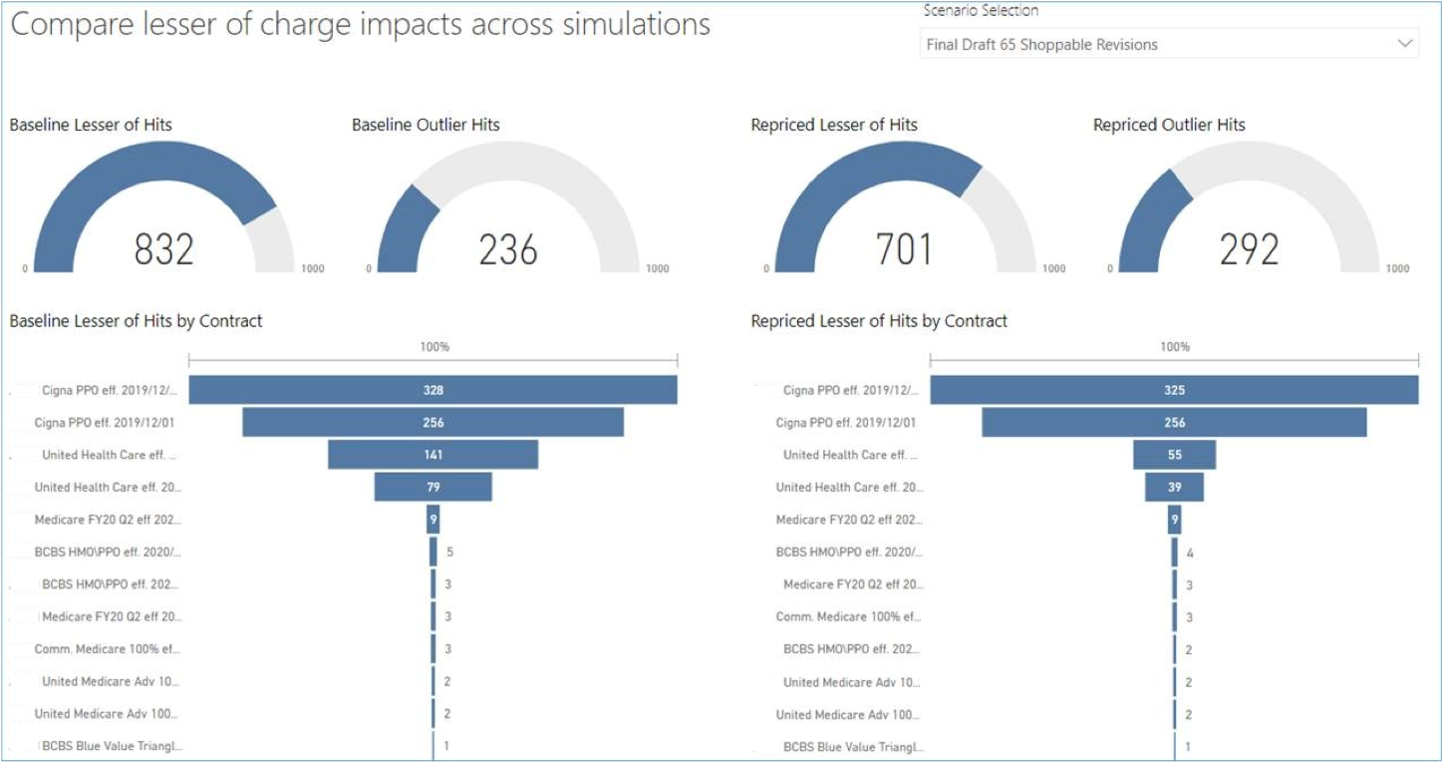

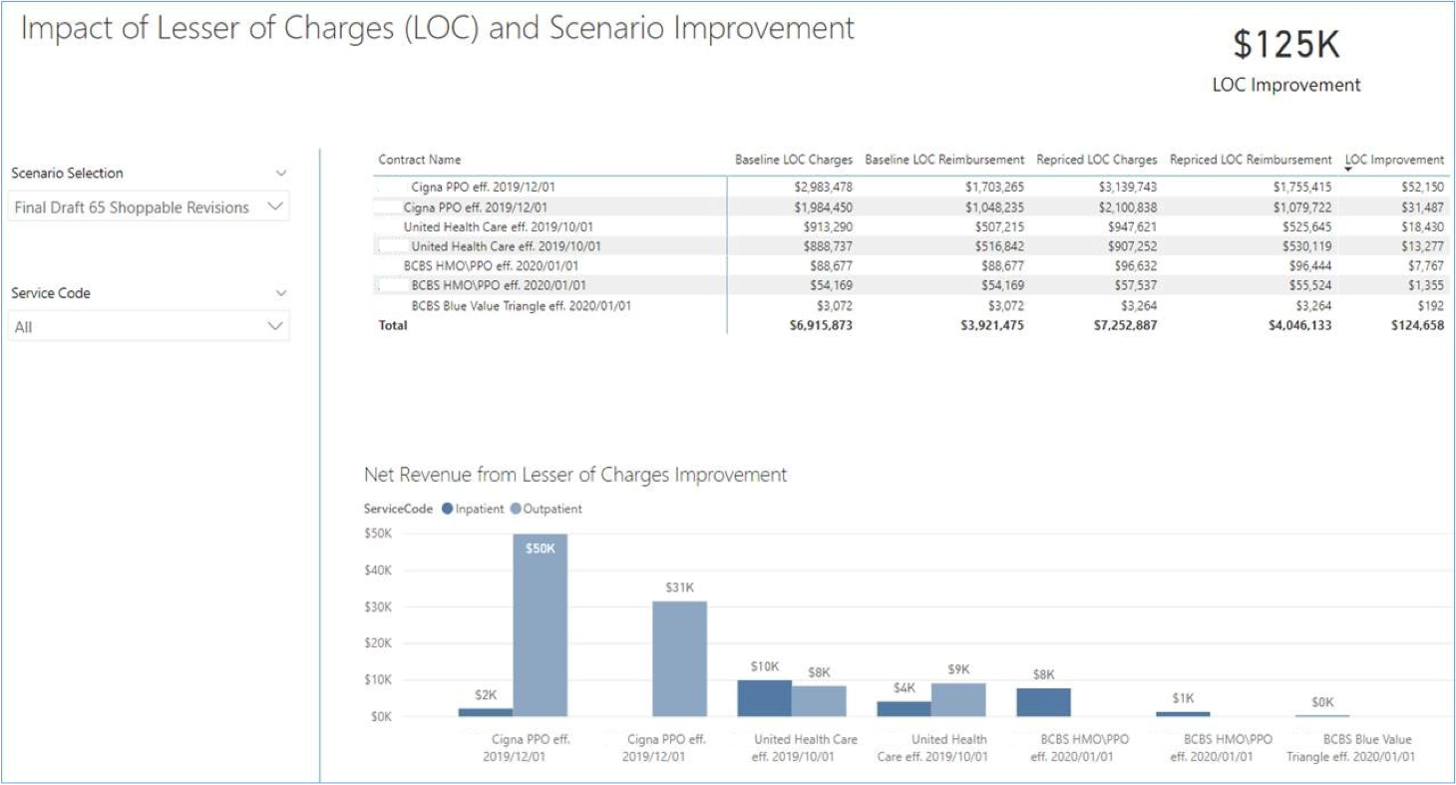

Below is a lesser of charges case rate analysis that shows baseline performance of lesser of charges and outliers that have occurred over the past year.

On the right side, we’ve taken the new Chargemaster changes, repriced our historical patients, and run them back through the contracts to see what impact I have made to lesser of hits and outliers.

We were able to get the lesser of hits down from 832 to 701 in this scenario:

If you are decreasing some items on your CDM and see your lesser of charges start to go up with a scenario, you’ll need to dig in and understand what codes you impacted that likely brought cases below the threshold. When you start digging, you’ll understand if this is related to one contract or if this is more widespread across contracts.

For those of you that are responsible for adjusting charges, you have a big tedious job. I know how much detail you have in front of you and the hours of time you spend adjusting prices, evaluating, making a few tweaks and then doing it all over again.

It's important to take a step back from your task of adjusting prices and think about how lesser of charges is getting in your way of rational, defensible pricing.

Benchmarking each payer’s lesser of charges impact against each other and sharing this with Managed Care will be key to shaping the future of your pricing strategy.

This data needs to be part of the next negotiation and if you can share this insight internally, you may be taking an early step in helping the organization maintain market share and protecting the financial health of your organization.

Not to mention, your lesser of charges headaches may ease up if Managed Care helps address them.

6. Analyze Pharmacy and Supply Items

Two areas that are often neglected from modeling are pharmacy and supplies.

Because they are on their own markup schedule, many have carved it out from the annual projects. Over the years, we’ve found a number of hospitals that don’t keep the cost and markup current. Many items received prices when they were originally set up and they haven’t been updated since.

Another reason these areas have been neglected is that the data isn’t as readily available for you to benchmark.

One of the ways we help address this is to use the CMS Inpatient Standard Analytical Files to extract charges by revenue code category. We can pull pharmacy or supply revenue codes and benchmark against peers.

If you appear particularly lower or higher, it points to a difference in charges or utilization that you’ll likely want to address.

We can do this type of analysis for all revenue code categories and you can quickly see if an area stands out.

At a glance I notice that the first hospital in this dashboard has an unusually large block of brown, which represents supplies.

I also notice that the middle hospital whose charges seem much lower, has a slightly larger block of lavender so I’d want to drill into that service as well, to understand what is driving the inconsistency.

You have to slice and dice the data different ways to uncover some of the hidden issues.

7. Develop a Pricing Strategy

Assemble a pricing team, perform a Service Line Analysis, and then answer these questions:

-

Who are your competitors?

-

What is your market price position today?

-

What is your market share percentage?

-

What are the projected volumes?

-

What is the profitability?

-

How do your commercial contracts pay related to Medicare?

-

How do you leverage competitor's charge and reimbursement data for your pricing strategy in 2021?

Evaluate whether you can do this internally or should hire a vendor or consultant. Ask yourself these questions:

-

Are you able to analyze and adjust pharmacy and supply prices?

-

How do you accurately measure charge sensitivity overall and at service line level?

-

Are you able to analyze and adjust your rate schedule for professional services?

-

Do you have a logical, defensible pricing policy?

-

Are you able to quantify the lesser of charges and outlier impacts?

-

How is your Chargemaster vendor modeling your data?

-

Does your Chargemaster vendor ask clarifying questions to accurately model contracts?

-

Does your Chargemaster vendor share the lesser of charges impact at the case level?

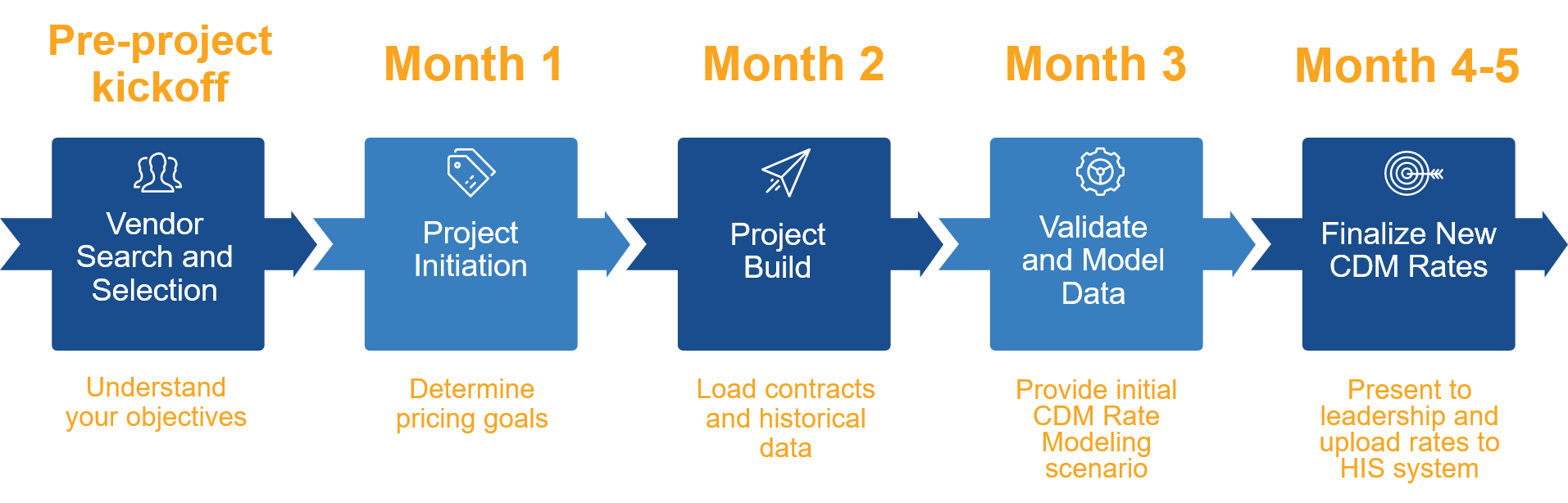

Plan 4-6 months ahead

We recommend planning 4-6 months before you have to submit charges for the next fiscal year. Here is a timeline of what that might look like:

Hit Net Revenue Goals on Your Next Chargemaster Review

A Chargemaster review can be daunting, but it doesn't have to be.

By implementing the steps above and using Chargemaster software, you can still achieve your net revenue goals while meeting new price transparency demands.

Learn how PMMC can help with your hospital's chargemaster review today!